First Class Tips About How To Choose Discount Rate

Discount rate based on current cap rates in your market.

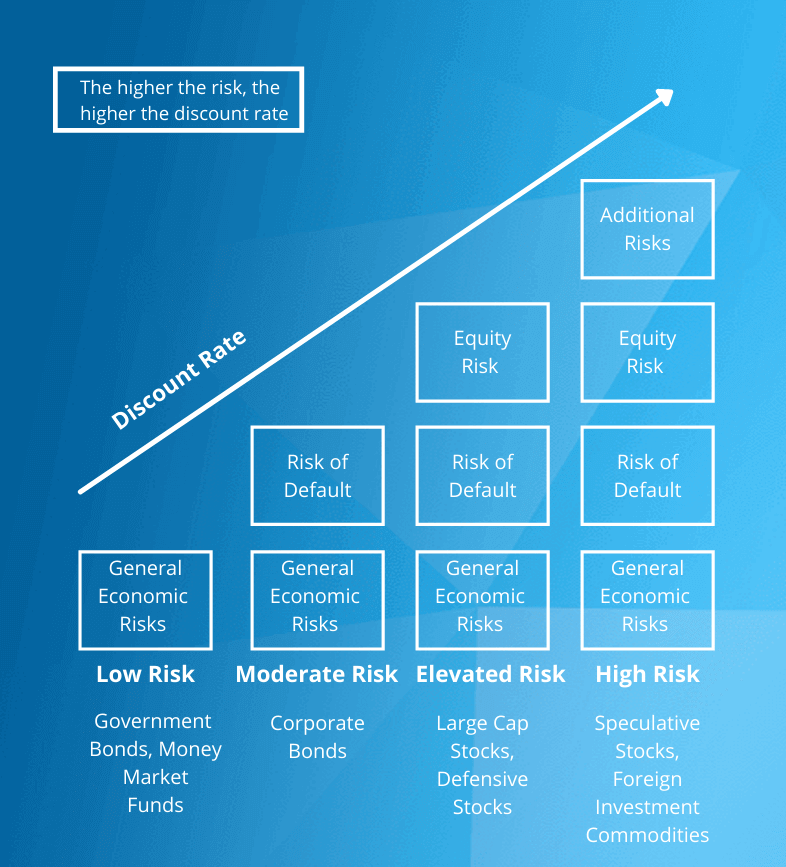

How to choose discount rate. How to choose the discount rate. Read more (wacc) as a discount rate. Choosing a discount rate generally involves dealing with uncertainty.

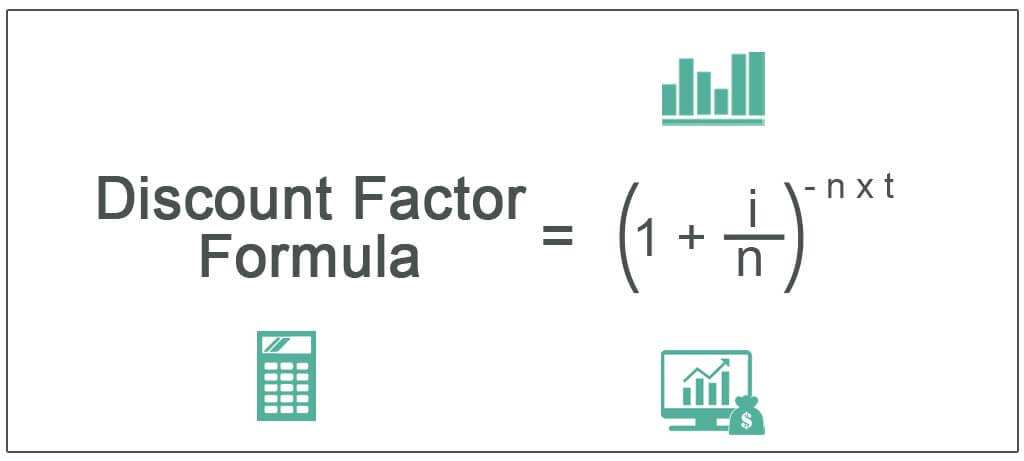

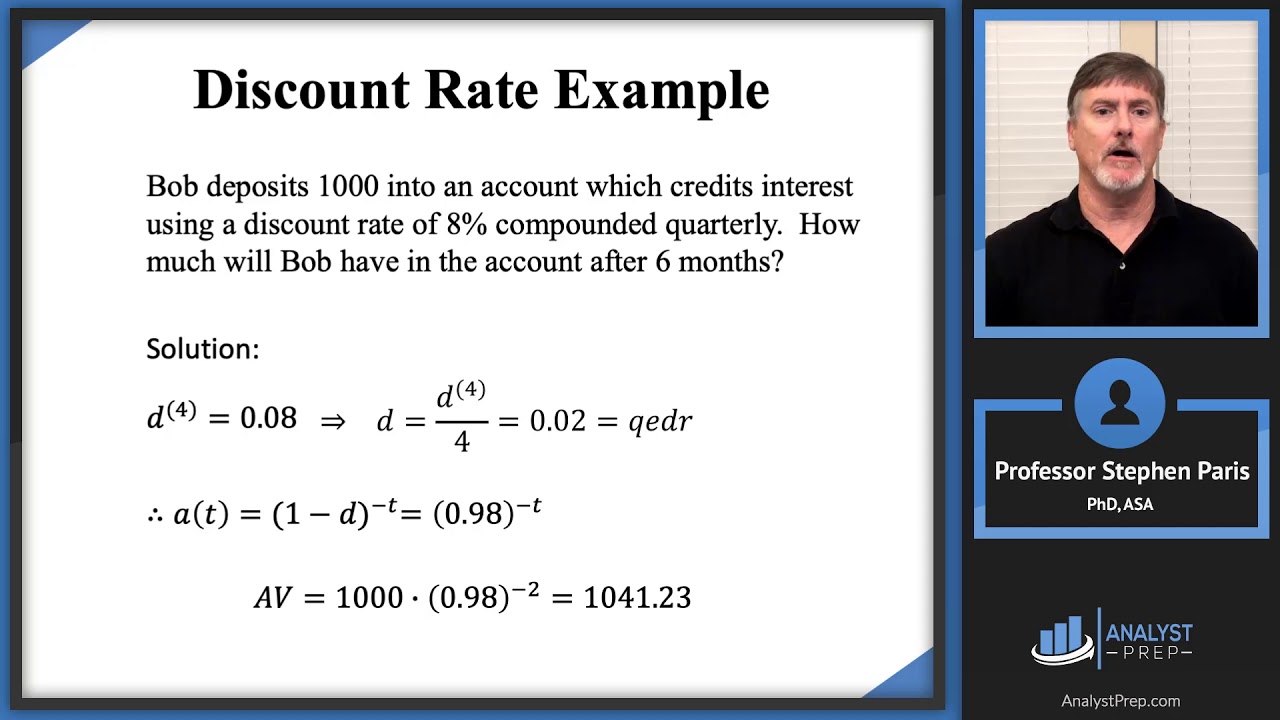

How does uncertainty affect which discount rate we choose? Formula for the discount factor. Wacc formula = [cost of equity * % of equity]

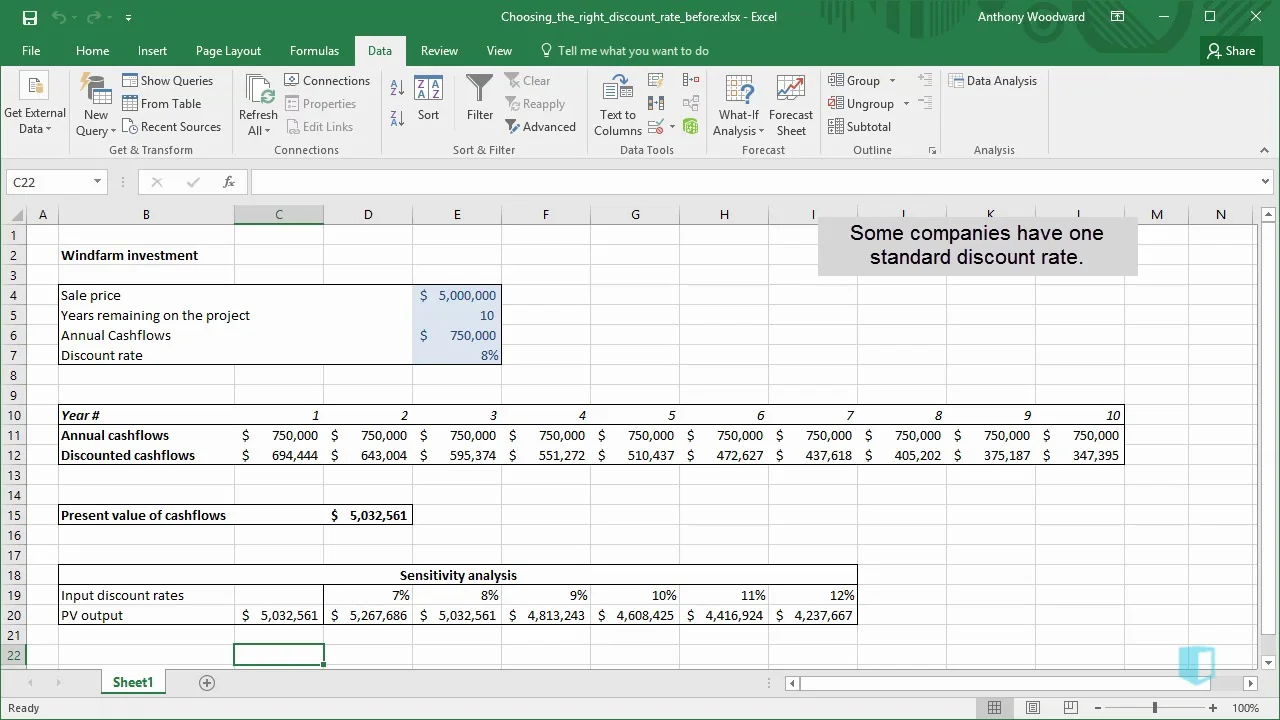

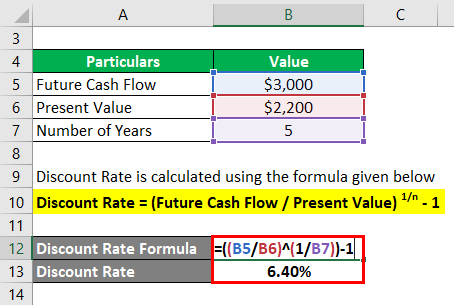

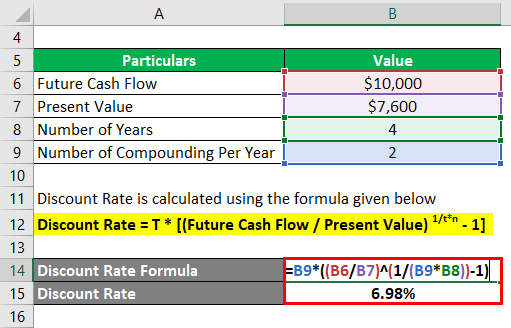

For this reason, the discount rate is adjusted to 8%, meaning that the company believes a project with a similar risk profile will yield an 8% return. How to choose a discount rate in real estate investment analysis. How to calculate discount rate:

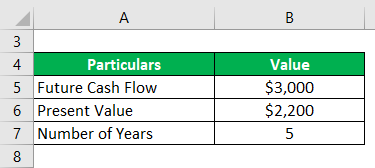

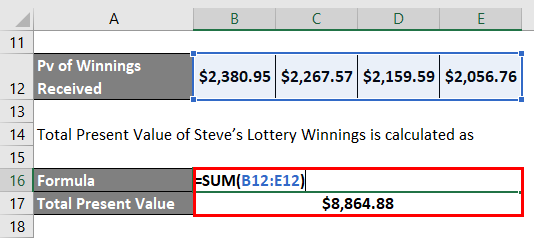

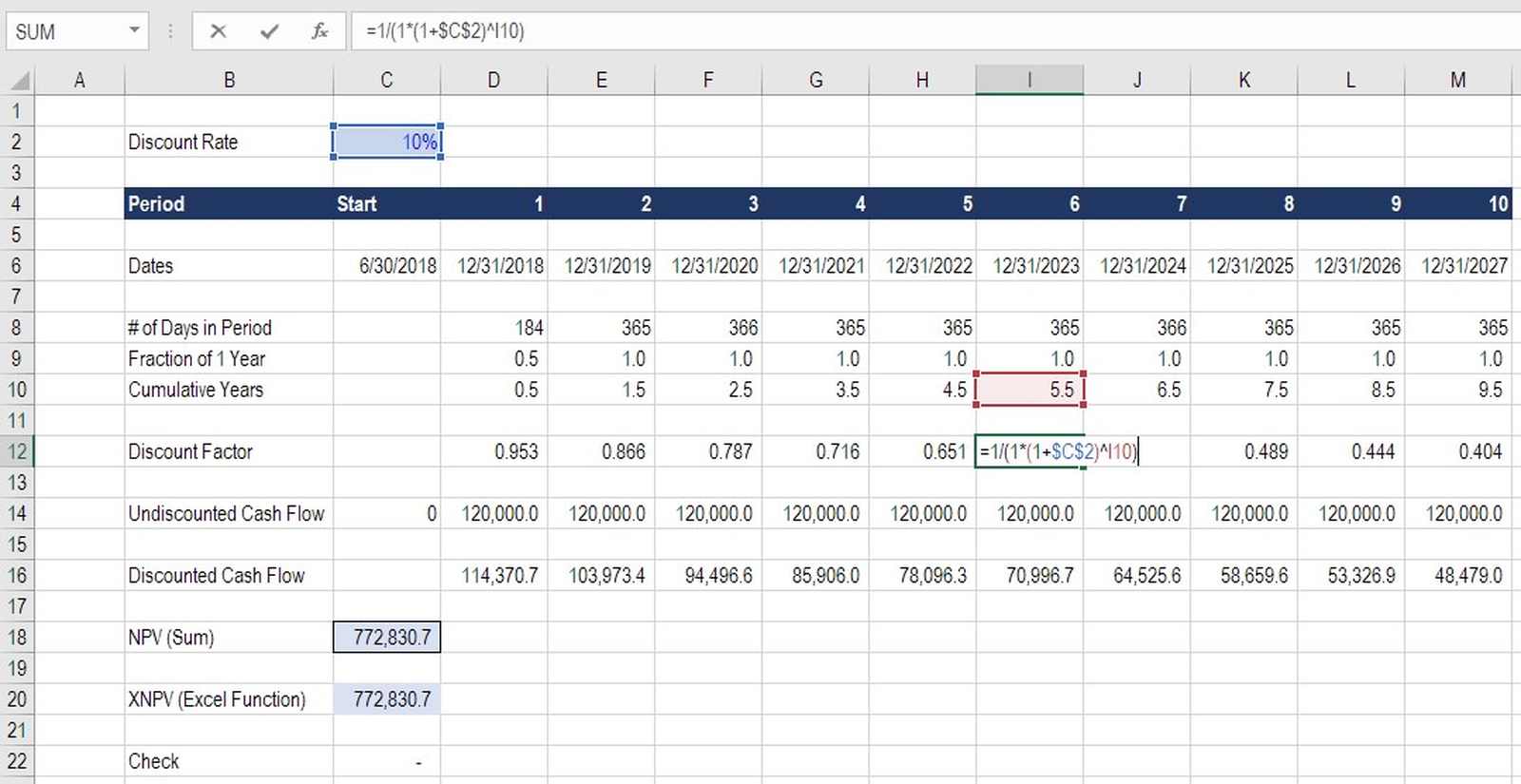

The formula for calculating the discount factor in excel is the same as the net present value (npv formula). Discount rates are usually developed beginning with the risk free rate (20 yr treasuries) then adding the equity risk premium, the industry risk premium, and the small company stock. Simply take the relevant cap rate and add in a reasonable growth estimate and you’ll have an approximate discount rate to use in.

Simply take the relevant cap rate and add in a reasonable growth estimate and you’ll have an approximate discount rate to use in your discounted cash flow analysis. Therefore, different types of rates apply. How to choose a discount rate in real estate investment analysis // if you're running a discounted cash flow analysis for a real estate investment, one of th.

The formula is as follows: As a first step, determine who the landowner or the beneficiaries of the forest are. The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the federal reserve's discount window.

![Discount Rate Formula: Calculating Discount Rate [Wacc/Apv]](https://www.profitwell.com/hs-fs/hubfs/CashFlowEquation%20(1).png?width=780&name=CashFlowEquation%20(1).png)

![Discount Rate Formula: Calculating Discount Rate [Wacc/Apv]](https://www.profitwell.com/hs-fs/hubfs/NPVEquation%20(1).png?width=780&name=NPVEquation%20(1).png)