Awesome Tips About How To Choose A Loan Modification Company

The first option that most people employ is to start their own modification company.

How to choose a loan modification company. When you are investigating different companies to help you modify your commercial loan look for a company. Available in 49 states, with physical branches in 32 states. Other loan terms — interest rate, length of the loan, even the loan type — can.

How to choose an honest loan modification company 1. Steps to start a loan modification business. Tips for choosing a commercial load modification company:

A creditworthy borrower may be able to qualify for interest rates lower. A few different reasons a loan refinance might be an advantage to a borrower are: Obtaining a mortgage modification can be very frustrating if you're in debt, and find it very difficult to make your monthly payments.

Picking commercial loan modification companies is a little bit like choosing a watermelon; Here are some tested and proven tips that will certainly help you to select the right loan modification service provider. It is not easy to know if it’s going to be a good one until you crack it open.

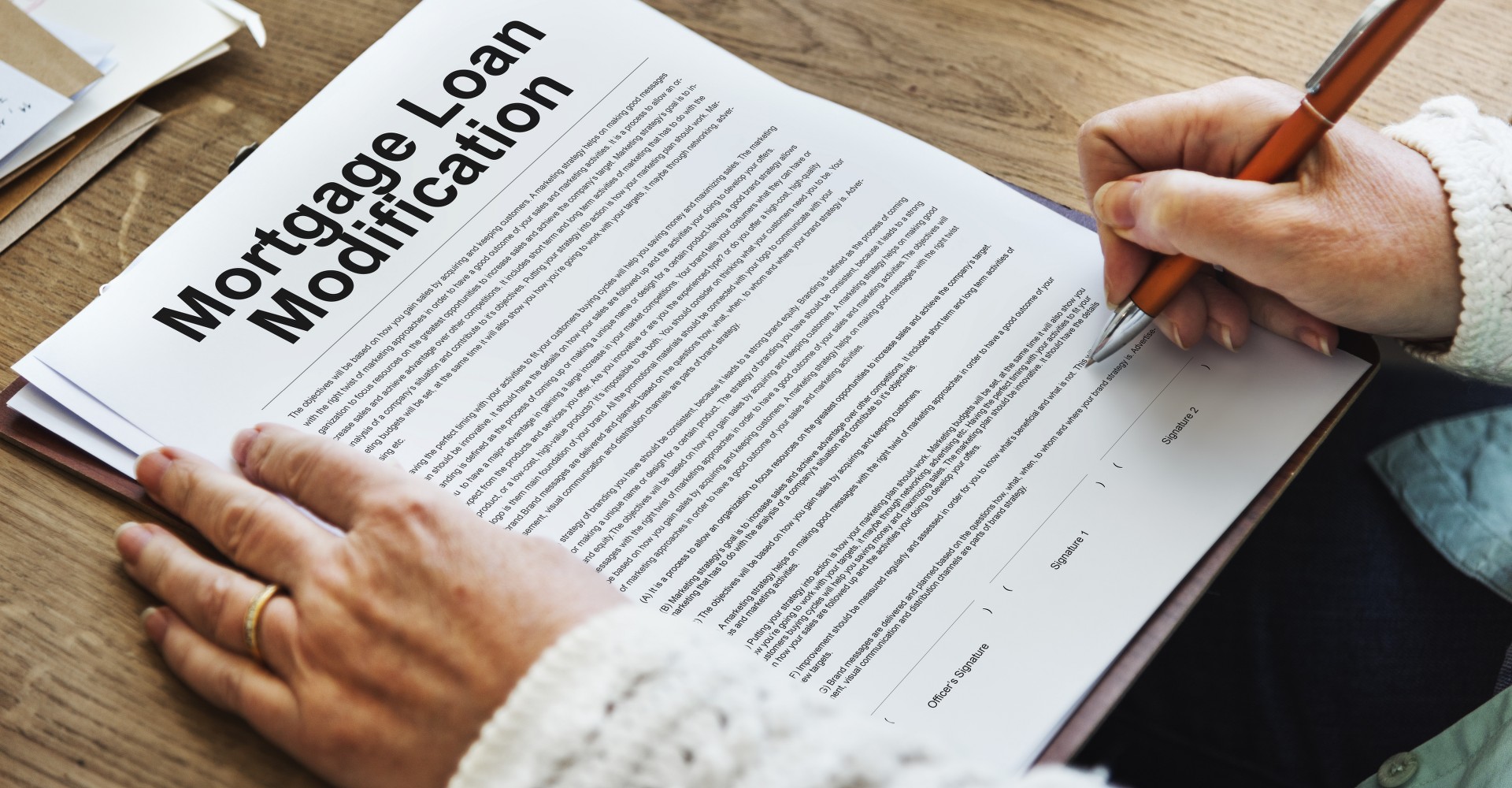

How to choose a loan modification attorney. First of all verify the legal status of the short listed loan. With one, homeowners would contact lenders on their own and appeal to them.

The principal owed on your home loan will always stay the same when you refinance your mortgage. With so many others applying for a loan, lenders are virtually swamped with requests. As negotiating for a mortgage modification can get frustrating, trying to find the assistance of a loan modification law firm is recommended.